Obtain more information about our firm and its financial professionals on FINRA’s BrokerCheck | Form CRS

The best kind of support is never one-size-fits-all.

The best kind of support is never one-size-fits-all.

Independence without compromise defines our entrepreneurial foundation. As a financial professional, you recognize that this business is not one-size-fits-all, and we at Money Concepts agree!

You want the best for your clients, we want what’s best for you. No matter what path of financial services you take, we’ll walk right alongside you to provide you with the support you need to succeed. Think of us as your strategic partner, helping you think through the options that work best for you and your clients.

Making the move to a new firm is an exciting process, but it can also be one filled with questions. Our transition process goes beyond just getting you appointed. Our team works in concert with you to customize the right transition approach for your business, and, more importantly, for how you work with clients.

Even before your appointment, our transition support will be here to guide you, and we’ll stay by your side through account movement, resource orientation, and engagement to Money Concepts.

Independence without compromise defines our entrepreneurial foundation. As a financial professional, you recognize that this business is not one-size-fits-all, and we at Money Concepts agree!

You want the best for your clients, we want what’s best for you. No matter what path of financial services you take, we’ll walk right alongside you to provide you with the support you need to succeed. Think of us as your strategic partner, helping you think through the options that work best for you and your clients.

Making the move to a new firm is an exciting process, but it can also be one filled with questions. Our transition process goes beyond just getting you appointed. Our team works in concert with you to customize the right transition approach for your business, and, more importantly, for how you work with clients.

Even before your appointment, our transition support will be here to guide you, and we’ll stay by your side through account movement, resource orientation, and engagement to Money Concepts.

What are your goals for your future and your experience from the past?

Whether you are fully licensed with a book of business or ready to enter our industry for the first time, Money Concepts has the path and support to meet you where you are. With our many options, you can select the path that’s right for you and receive financial assistance and support to meet your needs.

A fully licensed professional with an existing book of business will experience “hands-on” transition support and concierge service.

The Pathway Program provides the opportunity for administrative-experienced candidates to become fully licensed and work to becoming a full-time financial professional.

When you partner up with our tax platform, you’re gaining support to help you increase sales and maximize your revenue—as well as guidance to help you navigate common roadblocks faced by tax professionals. Above all else, we’re here to help you enhance your customer’s experience and provide you with the competitive edge you need to tap into new markets.

Are you an insurance professional seeking to expand your services? MCI/65 delivers a structured business model to effectively develop your advisory business to build upon your insurance foundation.

As one of the few independent firms that offers a career entry program, we strive to provide you with every resource you require to get a feel of what our industry has to offer. We even set you up with a mentor, allowing you to get an inside look at the ins and outs of our industry alongside an experienced professional. No matter what you’re looking for, our virtual university aims to help you cultivate your personal and professional growth.

Structured financial transition support to meet the flexibility needed for you!

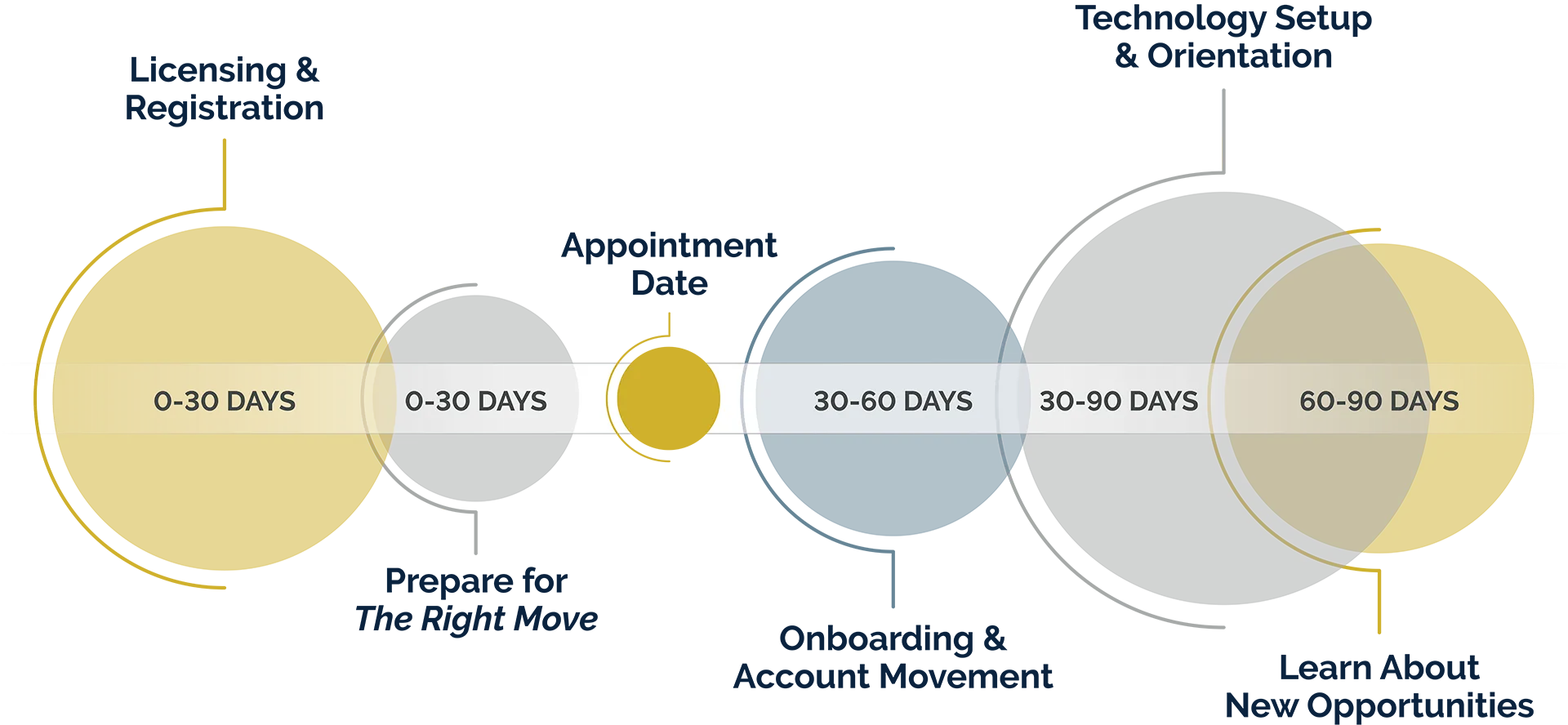

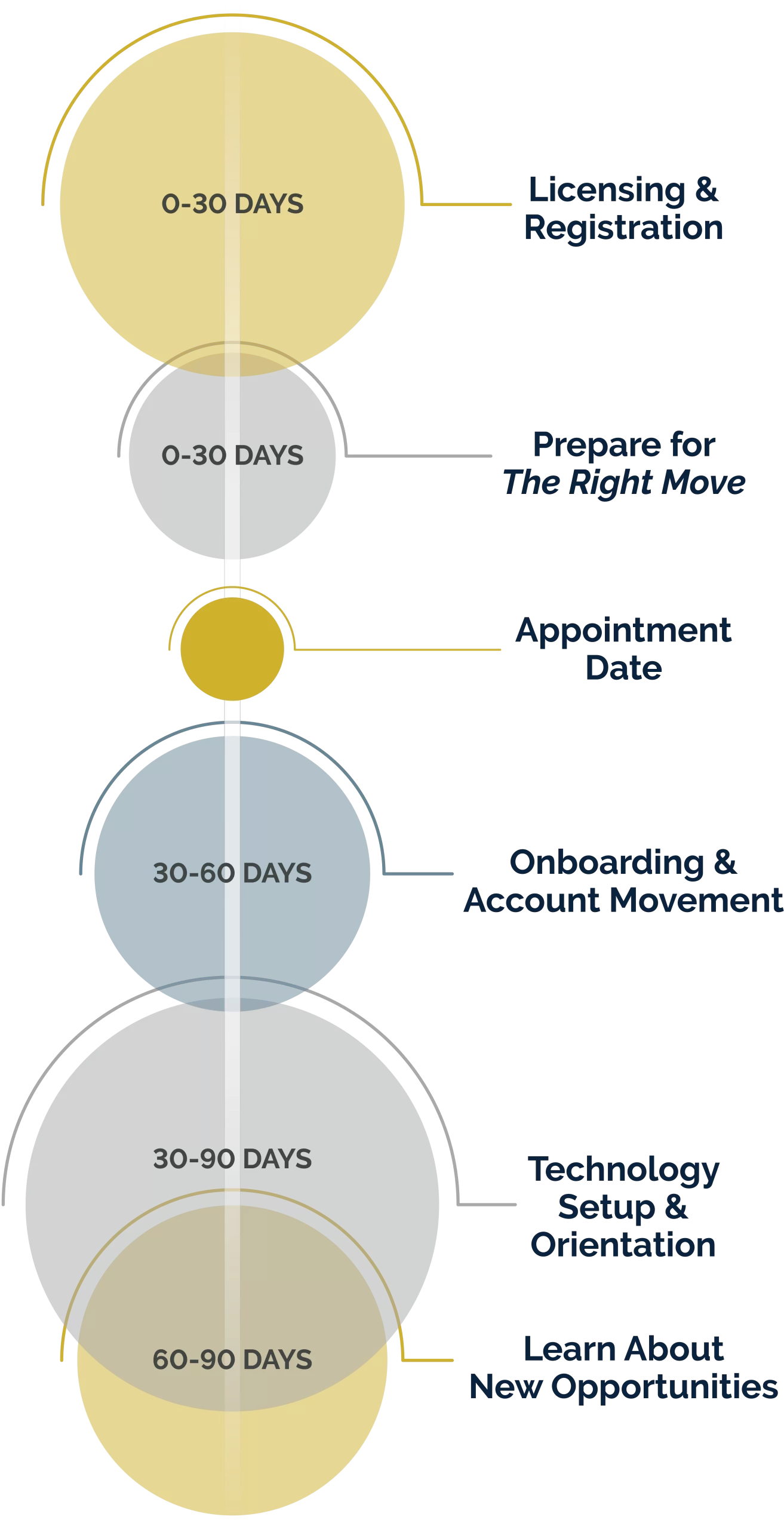

Our transition process is setup in three stages on a 90-day timeline and serves as a guide as we further personalize it to your needs.

Structured financial transition support to meet the flexibility needed for you!

Our transition process is setup in three stages on a 90-day timeline and serves as a guide as we further personalize it to your needs.

Ever since she entered the professional world, Lori Pottinger has been helping financial professionals of all experience levels move their business to Money Concepts. Growing up with a father who was a financial professional, her understanding of the intricacies involved with this profession have been developing since childhood. Every single one of Lori’s transition plans is curated around identifying and serving the values of your practice, essentially crafting customized solutions for what most would consider a standard process. Her dedication is endless, and she makes sure all her attention and care go towards getting the transition over successfully—and you back to business as soon as possible.

Ever since she entered the professional world, Lori Pottinger has been helping financial professionals of all experience levels move their business to Money Concepts. Growing up with a father who was a financial professional, her understanding of the intricacies involved with this profession have been developing since childhood. Every single one of Lori’s transition plans is curated around identifying and serving the values of your practice, essentially crafting customized solutions for what most would consider a standard process. Her dedication is endless, and she makes sure all her attention and care go towards getting the transition over successfully—and you back to business as soon as possible.

90 days is the timeline we use to measure transitions however this is a guide and not set in stone. You and your transition are unique, and we apply our structured process based on what is important to you.

Securities through Money Concepts Capital Corp. Member FINRA / SIPC. Investments are not FDIC or NCUA Insured. May Lose Value – No Bank or Credit Union Guarantee. Important Investing Information: Not all investments and services mentioned are available in all states. Money Concepts registered representatives are restricted to conduct business only with residents of a state and/or jurisdiction for which they are properly registered. When investing from outside of the United States, you are subject to the securities and tax regulations governing your jurisdiction. Contact us directly for detailed information about investment regulations outside of the United States.

Connect with us to discuss what that could look like for you.